Reports of cryptocurrency transactions greater than 10,000 dollars

FBAR vs 8938: Which One Should I File?

$10,000+ cash transaction reporting changes coming in 2024 - Don't

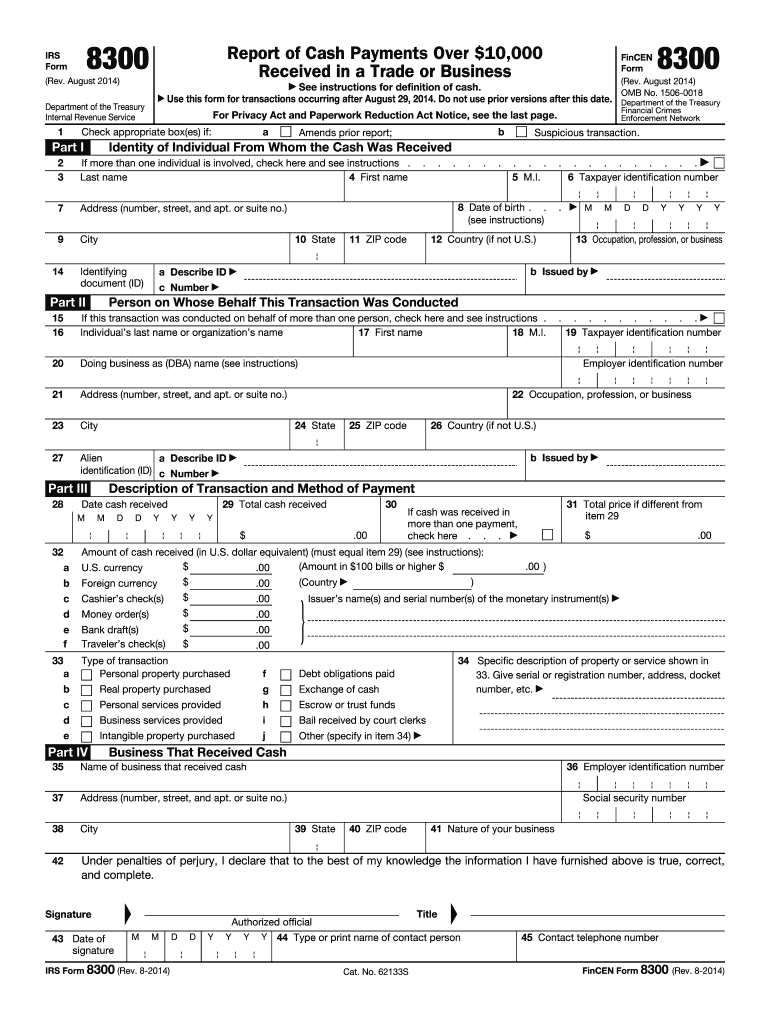

IRS Form 8300: Info & Requirements for Reporting Cash Payments

DiNatale, CPA+

Form 8300 - Report of Cash Payments Over $10,000 Received in a

Dealers Cash Reporting to IRS

IRS Mandates Electronic Filing of Form 8300 for Cash Payments Over

Things to know (and fear) about new IRS crypto tax reporting

3.11.250 Form 8300 Processing

Federal Register :: Beneficial Ownership Information Reporting

IRS Reminds Businesses That Form 8300 for Cash Transactions In

Crypto IRS Reporting Rules Promise Tax Compliance—And Enforcement

Form 8300 to Shift to Electronic Filing Platform - Taxing Subjects