Crypto Taxes USA 2023: Ultimate Guide

What's new in U.S. crypto tax regulation? A guide to crypto's

Dems Try To Pass Off $10,000 IRS Reporting Threshold as Merely

Biden proposes IRS disclosure of all crypto transactions $10,000

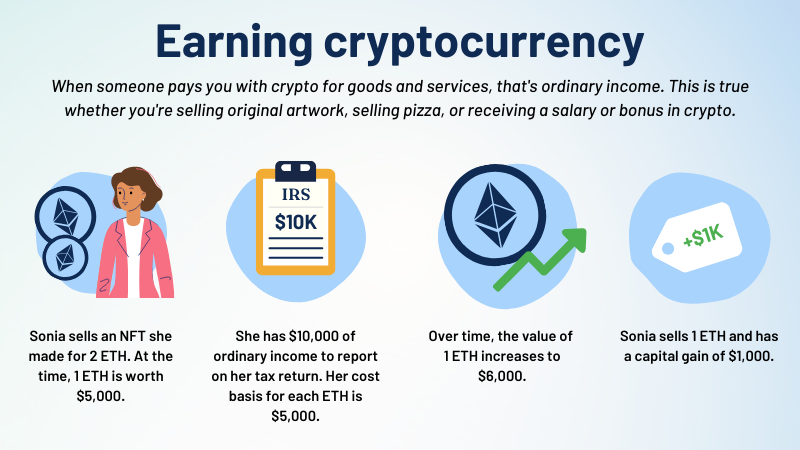

How Is Crypto Taxed? (2023) IRS Rules and How to File

Infrastructure Bill IRS $10,000 Bitcoin - Bitcoin Magazine

US Treasury may require crypto transfers over $10K to be reported

.jpg)

Over 150 Million Americans Must Report Crypto Taxes With IRS

Crypto Tax Accounting 2022: How to Report Cryptocurrency Taxes

Crypto tax avoiders face IRS roulette: Confess, or try to hide

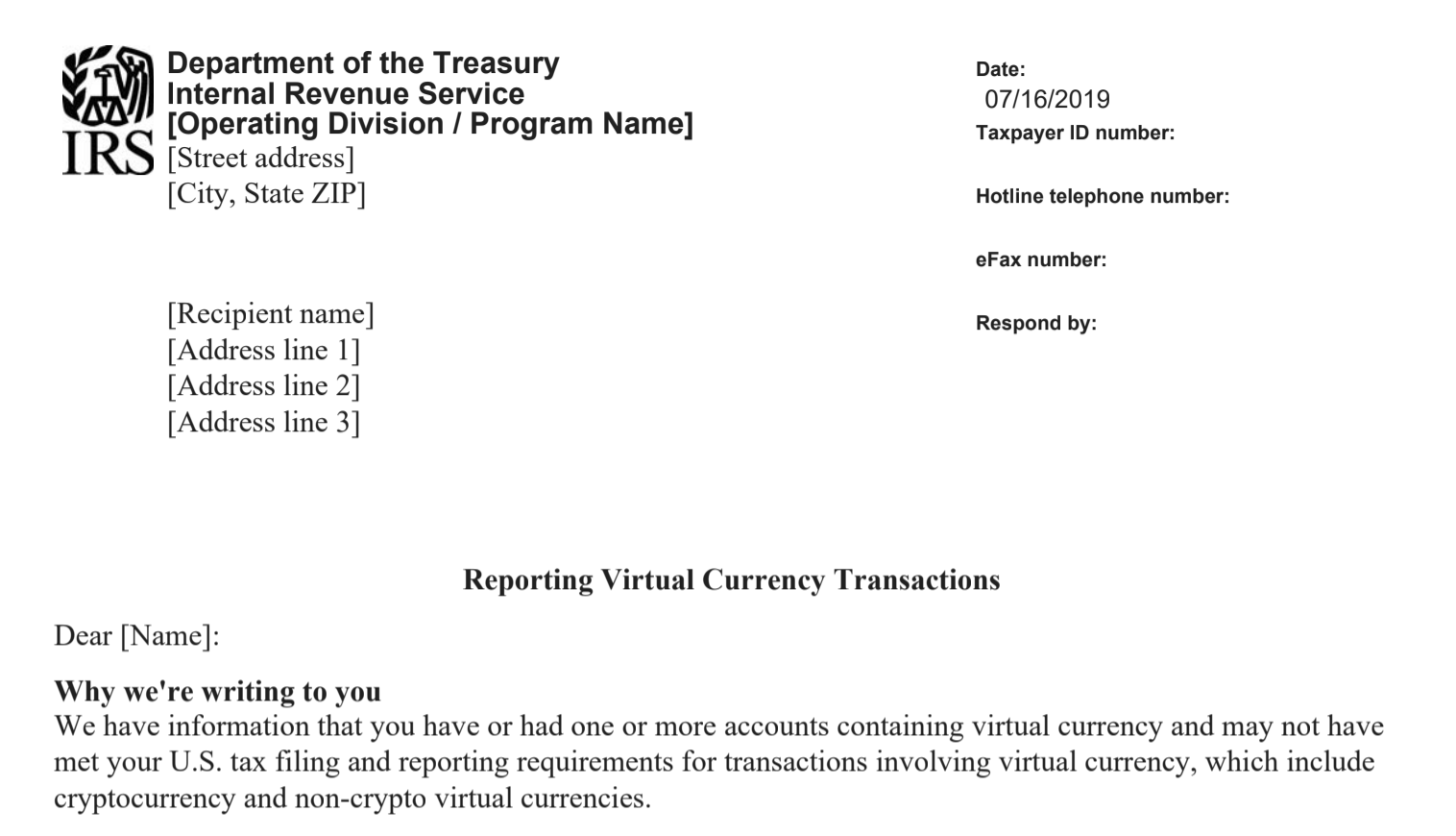

IRS Letters 6173, 6174, and CP2000 and Crypto Assets

IRS is warning thousands of cryptocurrency holders to pay their taxes

Understanding the New Tax Implications of Digital Currency - Unbanked

Crypto Taxes USA 2023: Ultimate Guide